US Treasury chief seeks looser regulation at financial stability panel

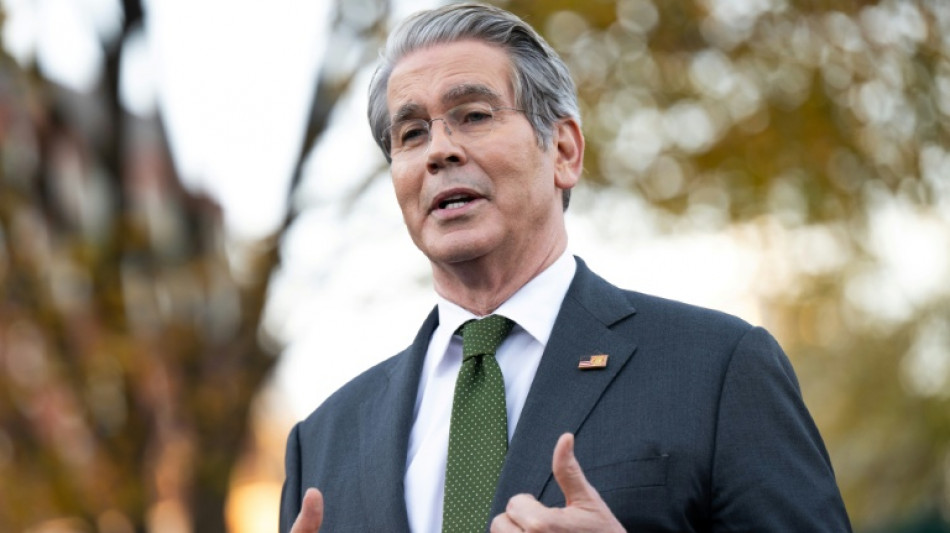

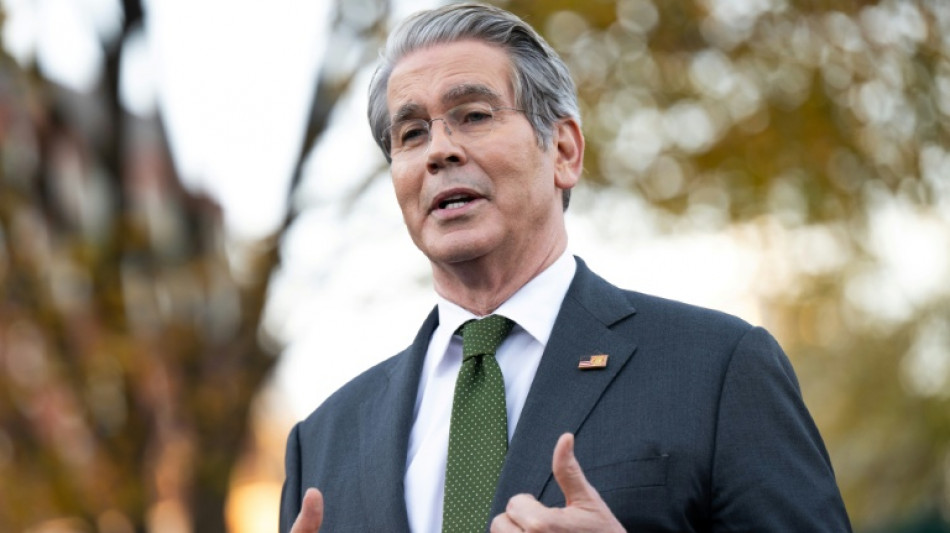

US Treasury Secretary Scott Bessent signaled key changes Thursday to a high-level panel on financial stability, putting more emphasis on economic growth and reduced regulation.

The panel, the Financial Stability Oversight Council (FSOC), was created to identify emerging risks and avoid a repeat of the 2008 global financial crisis.

Chaired by the Treasury secretary, it comprises representatives of top financial regulators including the Federal Reserve, the Securities and Exchange Commission, and the Federal Deposit Insurance Corporation.

"Too often in the past, efforts to safeguard the financial system have resulted in burdensome and often duplicative regulations," Bessent told an FSOC meeting on Thursday.

"Little thought was given to the harms of overregulation," he added.

He said the FSOC is working with member agencies to consider where the US financial regulatory framework imposes "undue burdens."

Bessent said the "twin priorities of economic growth and economic security will guide the Council's future approach" when it comes to identifying priorities, assessing risks and recommending regulatory changes.

The council's annual report this year also reflects the "reorientation" of the FSOC's priorities, Bessent said.

The change aligns with a focus on deregulation under the administration of President Donald Trump.

Ahead of the FSOC meeting, however, Elizabeth Warren, the top Democrat on the Senate Banking Committee, criticized the council's direction under Bessent's leadership.

"The FSOC has met less frequently than it ever has before; meanwhile, at the rare meetings when it does convene, Wall Street deregulation is a standing agenda item, and the Council is actively sabotaging its own authorities," Warren wrote in a letter to the Treasury chief dated Wednesday.

"This erosion of financial stability oversight would be troubling at any moment, but it is especially dangerous as systemic risk in the financial system appears to be intensifying," she said.

In a letter accompanying the new FSOC report, Bessent said that the council has formed new working groups.

They include one that will consider if regulation has "distorted or imposed undue costs" on equity and credit markets among others, "in ways that could negatively impact economic growth and economic security."

Another group looks into artificial intelligence to consider ways that it can boost financial system resilience.

At Thursday's meeting, Bessent also urged FSOC member agencies to ease regulations that might discourage AI experimentation in the financial services sector.

K.Hernandez--SFF

London

London

Manchester

Manchester

Glasgow

Glasgow

Dublin

Dublin

Belfast

Belfast

Washington

Washington

Denver

Denver

Atlanta

Atlanta

Dallas

Dallas

Houston Texas

Houston Texas

New Orleans

New Orleans

El Paso

El Paso

Phoenix

Phoenix

Los Angeles

Los Angeles